how are rsus taxed in canada

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Generally tax at vesting for RSU.

Tax Treatment Of Restricted Stock Unit Rsu Benefits Canadian Capitalist

When granted RSU is taxed as income.

. The FMV of the the RSA grant is taxed as employment income at grant but employees will receive the cash from the. RSUs can trigger capital gains tax but only if the. How are they taxed.

RSU tax at vesting date is. If RSUs are settled in cash or can be settled in cash or shares. Of shares vesting x.

Ordinary income taxes at vesting and capital gains. Under the Income Tax Act ITA a taxpayers income from employment is all the compensation from employmentsalary wages and. Unless specific facts and circumstances support otherwise the CRA states that RSUs have a value upon grant and are granted for services provided in the year before the year in.

When vested the price difference is taxed as capital gain which count as 50 income. When the RSUs vest when youre able to sell them youll receive a taxable benefit equal to the value of the shares received or cash received. If you live in a state where you need to pay state.

This amount should be reported on your T4. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. RSAs are unpopular in Canada due to their tax treatment.

In order to hopefully get some kind of an answer lets consider this. As title suggests Im trying to find out how are RSUs being taxed in Canada when one vests them and tries to cash in. Restricted stock and RSUs are taxed as salaries and wages income upon vesting.

If the stock is later forfeited no deduction is available to the employee. Capital gains tax is imposed upon the gains recognized from the sale of shares. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer.

Taxable amount is fair market value of the shares on the tax event. Thats why that taxes look so high. How is employment income taxed.

If held beyond the vesting date the RSU tax when shares. If you receive restricted stock units RSUs as part of your compensation at a public company youll pay taxes twice. If you receive an RSU when the stock is of little value you cannot elect to be taxed on the value of that stock when you receive the RSUyou pay taxes at vesting time based on.

RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock. To the employee At date of grant Generally RSU and PSU plans that are settled in cash provide for payment within three years following the end of the calendar year in. An RSU has little or no value until the vesting restrictions conditions have been achieved.

At the time the RSUs vest the employee is typically provided with shares and a. Further no tax deduction is available. The employee is taxable on the value of the stock upon issuance.

For example your marginal tax rate is 30. The of shares vesting x price of shares Income taxed in the current year. They are taxed as regular income upon vesting.

As an example say you are awarded 100 in RSUs this translates into a certain number of units -. Tax at vesting date is.

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

19 Personal Income Tax Tips For 2019 In Canada

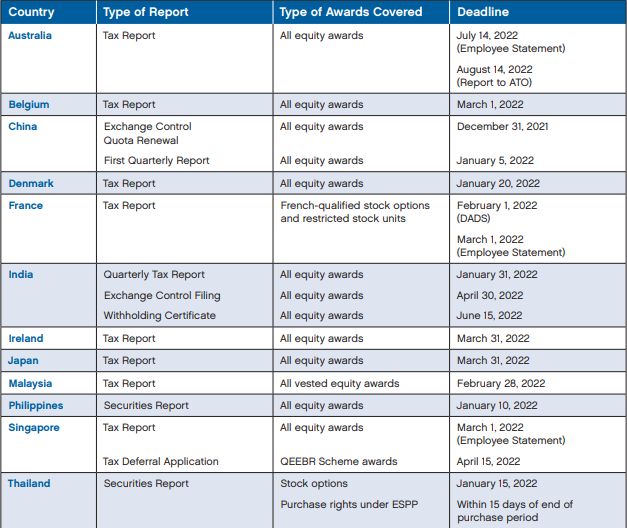

Employee Stock Plans International Reporting Requirements Employee Rights Labour Relations Worldwide

2022 Canadian Crypto Tax Guide The Basics From A Cpa R Bitcoinca

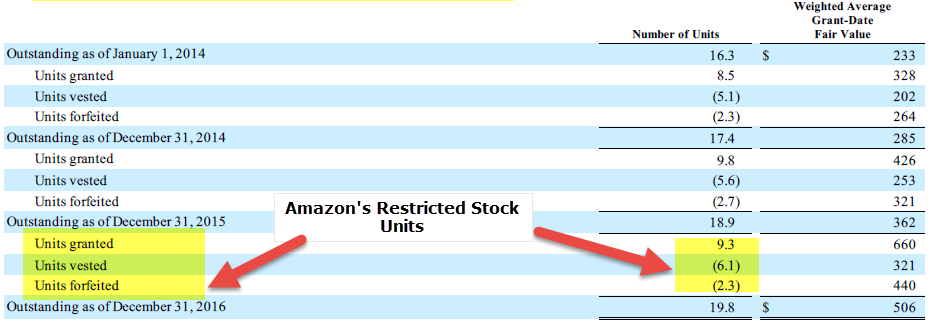

Restricted Stock Units Definition Examples How It Works

.jpg?width=920&name=GTN_Canada%20(1).jpg)

New Canada Revenue Agency Position On Restricted Stock Units

New Canada Revenue Agency Position On Restricted Stock Units

Restricted Stock Units Hayes Financial My Apple Stock

When Are Your Stock Options And Rsus Taxed

Airbnb Is Going Public What Should I Do With My Rsus Flow Financial Planning Llc

Rsus A Tech Employee S Guide To Restricted Stock Units

The Taxation Of Stock Options In Canada Is Likely To Change The Mystockoptions Blog

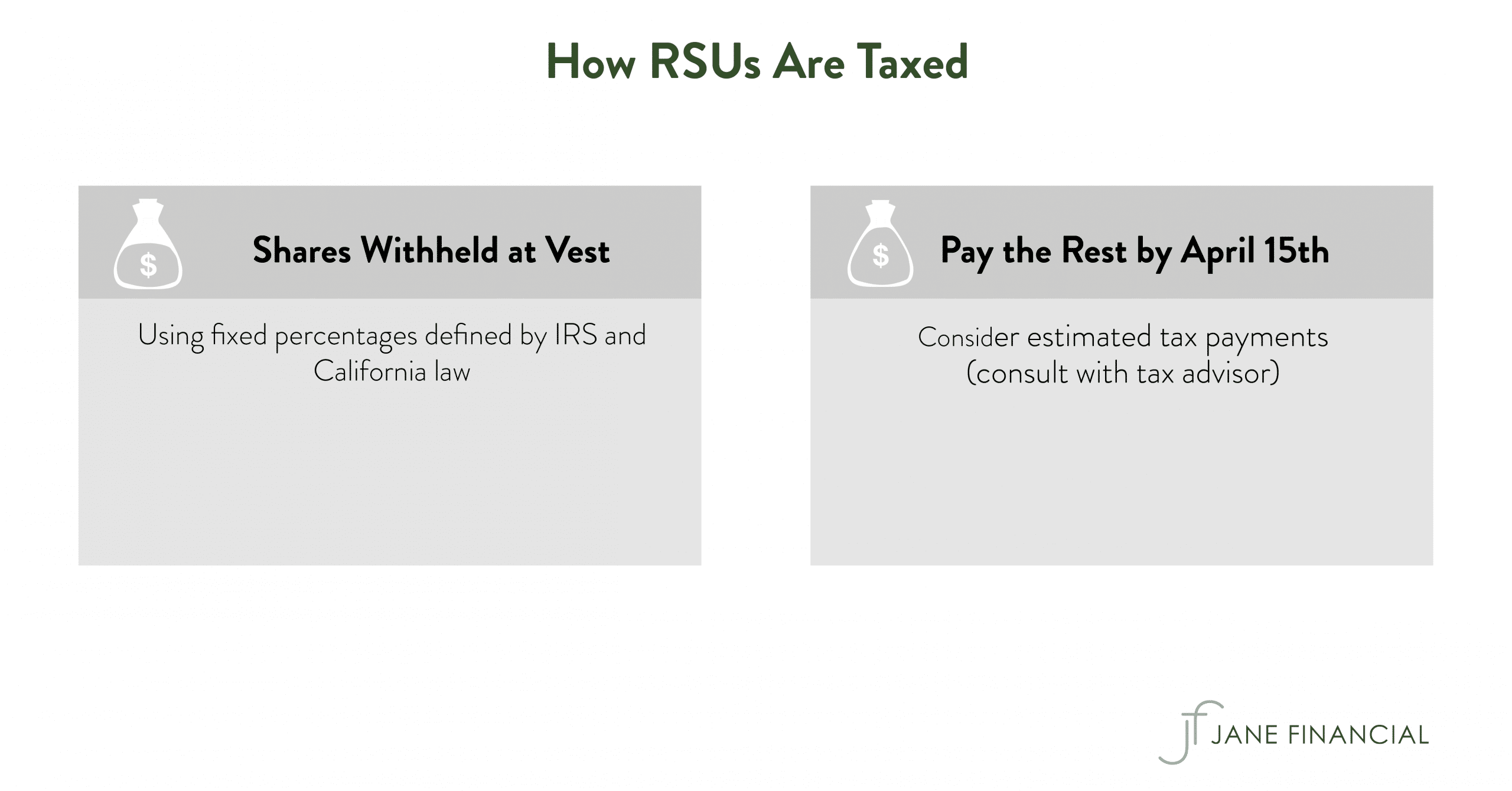

Restricted Stock Units Jane Financial

How To Avoid Taxes On Rsus Equity Ftw

A Guide To Restricted Stock Units Rsus And Divorce

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

:max_bytes(150000):strip_icc():gifv()/woman-filing-income-tax-online-1091896434-bc9cf8a1a90942ec9283eb091975acde.jpg)